|

||||||||

|

|

|

2016-05-17 ArtNo.45742

◆Over-regulation leads to shadow banking: Rajan

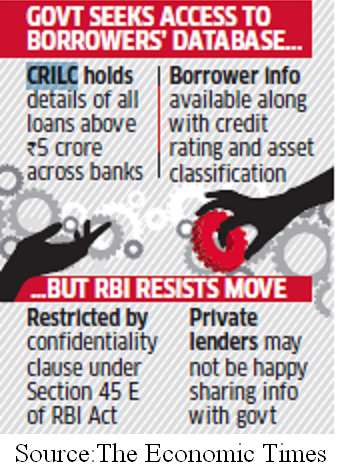

【New Delhi】Reserve Bank of India Governor Raghuram Rajan on the 7th of May warned against excessive banking regulation, saying this may lead to activities shifting to a shadow financial system. Delivering the K B Lall Memorial Lecture at the Nehru Memorial Library in New Delhi, he also suggested a "definite slowdown" in branch expansion by foreign banks in the country could be because of regulations, among other reasons. Rajan said: "What happens when you put pressure on one side of a balloon? It balloons out on the other side. So is there a danger that by regulating the banks so strongly, we have shifted the activity - not just risky activity but human capital - to a shadow banking system." ○Rajan warns against rising inequalities within countries  【Greater Noida】Reserve Bank of India Governor Raghuram Rajan on the 7th of May cautioned against growing inequalities within countries, even as it is diminishing between the nations. He emphasised on the role of education and healthcare to restore faith in markets in these circumstances. he said in his address at a convocation in Shiv Nadar University in Greater Noida in Uttar Pradesh. Addressing at a convocation in Shiv Nadar University at Greater Noida in Uttar Pradesh, he said making it easier for Dalits to start businesses would be more effective in bringing about social equality than any affirmative action in India. Calling money a “great equaliser”, he also called for raising society’s tolerance towards wealth rather than prohibiting its use. ○Finance Ministry seeks access to big borrowers' database, RBI denies permission  【New Delhi】The government and the central bank are in another dispute — this time over access to a database of borrowers with loans exceeding Rs 5 crore. The finance ministry has asked the Reserve Bank of India to provide information on all such borrowers. The ministry says this is to monitor the process of sanctioning loans, among other reasons. The information is contained in the Central Repository of Information on Large Credits, which was set up by RBI as one of the measures to prevent borrowers from gaming the system while seeking loans. Reserve Bank has not shared this information with the ministry. 【News source】 Over-regulation leads to shadow banking: Rajan Rajan warns against rising inequalities within countries Help Dalits start business to achieve equality: Rajan Rajan favours higher tolerance to wealth, not prohibition Finance Ministry seeks access to big borrowers' database, RBI denies permission ○One world: The aim of SEAnews ◆Recruitment of Ad-SEAnews CanvassersYour Comments / UnsubscribeSEAnews MessengerSEAnewsFacebookSEAnewsGoogleSEAnews eBookstoreSEAnews eBookstore(GoogleJ)SEAnews world circulation |

|

[Your Comments / Unsubscribe]/[您的意见/退订]/[ご意見/配信停止]

Please do not directly reply to the e-mail address which is used for delivering the newsletter. 请别用递送新闻的邮件地址而直接回信。 メールをお届けした送信専用アドレスには返信しないで下さい。 |